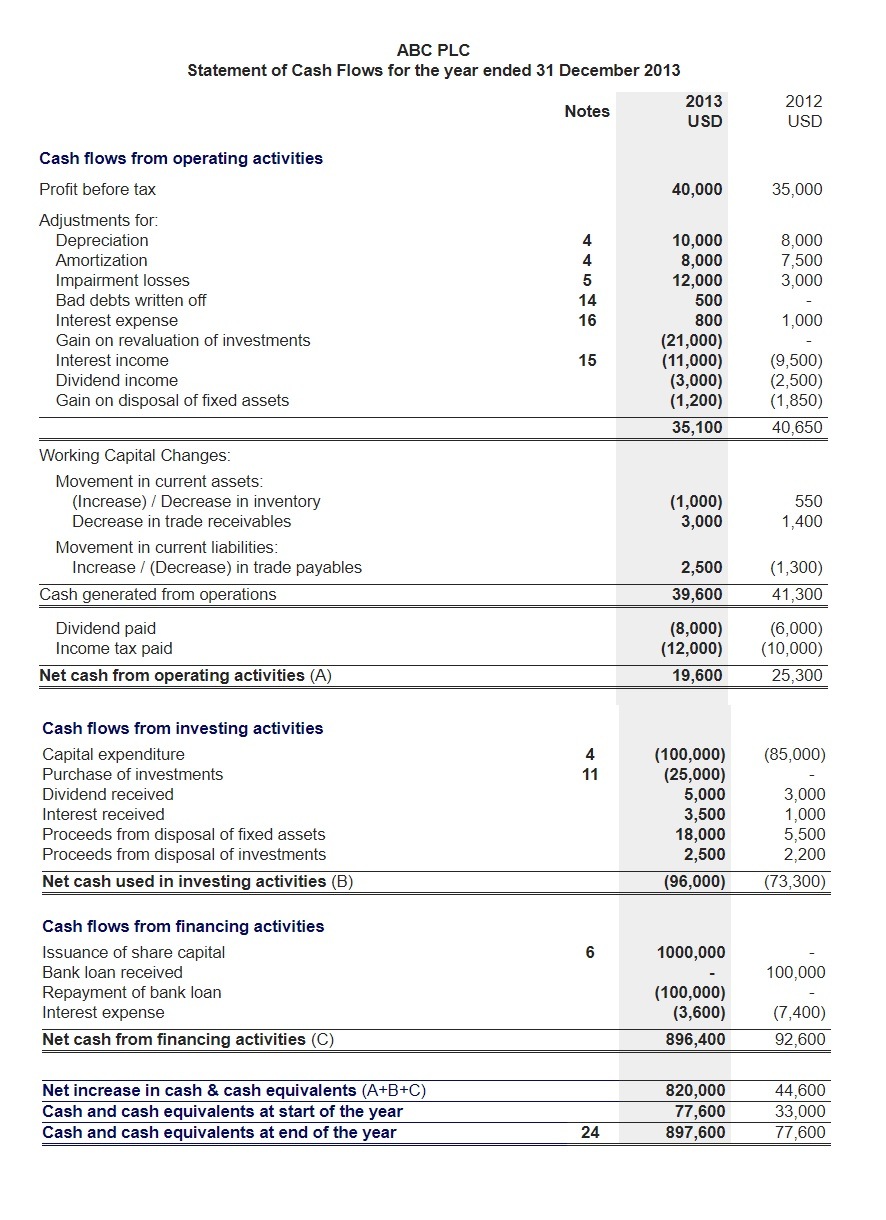

As you’ll see below, the statement is separated into three parts, where investing activities come in between operating activities and financing activities. Cash flow from investing activities typically refers to the cash generated in a company by making or selling investments and/or earning from investments. They are also used in several liquidity ratios, including the cash ratio, current ratio, and quick ratio. These are used to provide insights into a company’s ability to cover its short-term obligations, which is an important consideration when evaluating a company.

Accounting and Valuation Techniques

Examples of marketable securities include common stock, commercial paper, banker’s acceptances, Treasury bills, and other money market instruments. The CFI section of a company’s statement of Cash Flows includes cash paid for PPE. However, in the operating activities section of its Cash Flow statement, it includes the Depreciation expense that appears on its income statement under income from continuing operations. Cash flow from financing activities includes cash transactions that increase or decrease a company’s equity and/or liabilities.

Do you own a business?

Analysts can estimate the advisability of an investment in a particular company by the company’s ability to access cash and convert cash equivalents quickly. Companies with large amounts of cash and cash equivalents can be primary targets of bigger companies with acquisition plans. In accounting, marketable securities are current assets and sometimes work capital calculations on corporate balance sheets. Marketable securities on the balance sheet are a mixture of investments ranging from commercial paper, bonds, and money market accounts to stocks.

Great! The Financial Professional Will Get Back To You Soon.

- In this section of the cash flow statement, there can be a wide range of items listed and included, so it’s important to know how investing activities are handled in accounting.

- Analyzing changes in cash flow from one period to the next gives the investor a better idea of how the company is performing, and whether a company may be on the brink of bankruptcy or success.

- The tax treatment of marketable securities varies depending on the type of security, the holding period, and the investor’s tax jurisdiction.

We also allow you to split your payment across 2 separate credit card transactions or send a payment link email to another person on your behalf. If splitting your payment into 2 transactions, a minimum payment of $350 is required for the first transaction. All participants must be at least 18 years of age, proficient in English, what is bank reconciliation definition examples and process and committed to learning and engaging with fellow participants throughout the program. Our easy online enrollment form is free, and no special documentation is required. Harvard Business School Online’s Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills.

Corporations also face unique tax considerations when dealing with marketable securities. For instance, the dividends-received deduction allows corporations to exclude a portion of the dividends received from other taxable domestic corporations, reducing their taxable income. Additionally, corporations must account for the tax implications of unrealized gains and losses on their financial statements, which can affect deferred tax assets and liabilities. Proper tax planning and compliance are essential to optimize the tax position and avoid potential penalties. Debt securities are essentially loans made by investors to entities such as corporations or governments. Treasury bills are short-term instruments issued by governments, considered low-risk due to government backing.

Similarly, the statement of cash flow portrays the company’s net cash flow for a certain financial period. The purchasing of new equipment shows that the company has the cash to invest in itself. Finally, the amount of cash available to the company should ease investors’ minds regarding the notes payable, as cash is plentiful to cover that future loan expense. If something has been paid off, then the difference in the value owed from one year to the next has to be subtracted from net income. If there is an amount that is still owed, then any differences will have to be added to net earnings.

There are more items than just those listed above that can be included, and every company is different. The only sure way to know what’s included is to look at the balance sheet and analyze any differences between non-current assets over the two periods. Any changes in the values of these long-term assets (other than the impact of depreciation) mean there will be investing items to display on the cash flow statement. Debt securities require different valuation approaches, primarily because they involve fixed income streams.

CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation. CFI is on a mission to enable anyone to be a great financial analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path. Now that you have a solid understanding of what’s included, let’s look at what’s not included.