Accounts payable management is essential when running a small business, because it ensures that your accounts payable contributes positively towards your business’s cash flows. This means it helps you to minimize late payment costs, such as interest charges, penalties, etc. It is an important cash management tool and its use is indeed two-fold. You as a business can be viewed as a supplier, and your accounts receivables represent the amount of money you lend to your customers. Likewise, you are also a customer of your vendors and your accounts payable represent your borrowings from such suppliers. Once the vendor is paid back pertaining to the due dates a final journal entry is recorded for the transaction, debiting the entire amount from accounts payable account.

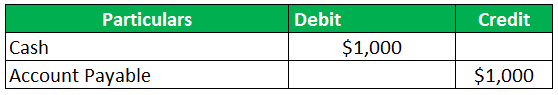

When the payment is made to a creditor or supplier:

Acme posts a debit to increase the machinery asset account (#3100), and posts a credit to increase accounts payable (#5000). The owner or someone else with financial responsibility, like the CFO), approves the PO. Purchase orders help a business control spending and keep management in the loop of outgoing cash. Accrual accounting requires firms to post revenue when earned and expenses when incurred to generate revenue. All businesses should use accrual accounting so that revenue can be matched with expenses, regardless of the timing of cash flows. Once the purchase invoice is received, it is assigned internally for processing.

Repeat the Process

Discover how to do a cash flow analysis and learn to monitor, forecast, and optimize your cash flow to ensure your business’s financial stability and growth. Discover 8 best practices to streamline processes, boost efficiency, and achieve better what are t accounts definition and example financial outcomes. Explore key metrics and strategies to optimize cash flow and ensure financial stability and growth. The manual handling of this process can be a ground for errors, delayed payments, and strained vendor relationships.

Review Supplier Contracts Regularly

If the buyer maintains a purchases returns and allowances journal, then the goods returned by him would be recorded in that journal, rather than in the general journal. With the net method, if you pay your supplier within the agreed-upon time period, you’ll get a certain percentage of the discount. As a result, there will be no need for you to manually enter or upload all your invoices, and your purchase and payment process would also get automated.

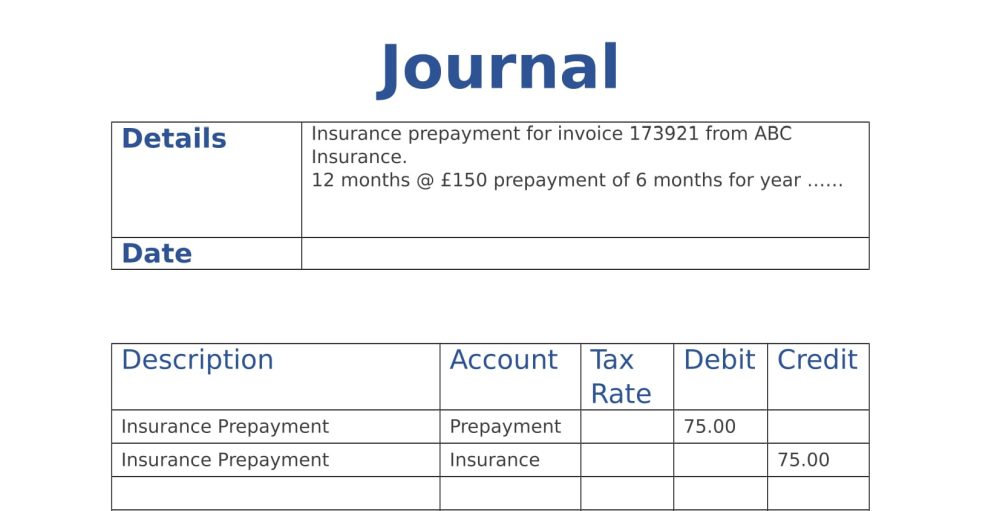

Entering an invoice payment

Liabilities, on the other hand, increase on the right side of the equation, so they are credited. The receipt includes a description and the number of items included in the shipment. Assume, for example, that Acme Manufacturing needs to order a $10,000 piece of machinery. Before the order is placed, the plant manager must complete a PO, which lists the machinery’s price and other details. Here in this example, the CDE company saved 40 dollars by making an early payment. He draws from his studies of economics and multiple years of bookkeeping experience where he helped businesses understand and measure their financial health.

- Since we typically follow a double-entry bookkeeping system, there has to be an offsetting debit entry to be made in your company’s general ledger.

- Credit duration in the credit term is usually 30 days, but it can vary depending on the type of business and the relationship between the company and its suppliers.

- The accounts payable journal entry process is a largely hectic and ongoing one.

- An accounts payable journal entry is simply a journal entry that gets recorded on the general ledger where at least one side of the double entry is made to the accounts payable account.

In cases where damaged goods are returned to the vendor, the amount is either adjusted against the next purchase from the vendor or is credited to the buyer’s accounts immediately. In this case, the money put on hold in the accounts payable account gets debited and credited back to the return account. A high AP turnover ratio means you’re paying your suppliers quickly, whereas a lower ratio shows that you pay suppliers back more slowly. Most businesses build a report that tracks this ratio every month or quarter to see a trendline, which can provide insight into your cash flow management and financial position. An accounts payable disbursement report is a list of all the entries you’ve created when you process payments to your suppliers. In other words, it shows all payments leaving your AP account over a specified period of time.

When you receive an invoice, you’ll likely be posting to an expense account, which will impact your income statement. Meanwhile, obligations to other companies, such as the company that cleans the restaurant’s staff uniforms, fall into the accounts payable category. Both of these categories fall under the broader accounts payable category, and many companies combine both under the term accounts payable. Try BILL for yourself and see how we save AP teams an average of 50% of their time by streamlining every step of the accounts payable process. The most common examples of this are when an invoice is received (balance increases) and when an invoice is paid (balance decreases).

This ensures that the services mentioned in the invoice have been agreed to and are payable to the vendor. If a bill is out of order, the business approver can reject the invoice, and the AP team raises the issue to the vendor. The company uses the periodic inventory system to account for the discounts using the gross method.

Therefore, they also result in outflows of economic benefits in the future. The amount that must be paid to the organisation’s creditors for purchased products and services is recorded in the Accounts Payable journal entries. This account is debited anytime a payment is made and displayed on the income statement under the current head liabilities section. When the company buys or purchases on credit, the liability will occur when goods or services are received. Hence the company will debit goods received or services expended and credit accounts payable as liabilities increase. In this case, goods can be inventory, fixed assets or office supplies, etc. and services can be consultant fee, maintenance, and advertising expense, etc.

It is the short-term debt obligation of a business towards its creditors. When we post a debit to a cash account, we’re increasing the amount of cash on our balance sheet. The same goes for all other assets, including accounts receivable, inventory, and assets. Accounts payable are the amount that the company owes to its suppliers while account receivables are the amount that the customers owe to the company. The payables are current liabilities when the receivables are the current assets.

The supplier’s late policy is a $100 late fee and 3% interest on the invoice amount ($300 for a $10,000 invoice). For the description, note the invoice number and what the invoice was for. Debits and credits must be equal on every transaction and on the account as a whole.