The advantage of this method is that it can be used to screen several competing projects quickly. For example, some organizations prefer to invest in projects with a minimum rate of return. This tool can identify the investments that meet a specific minimum rate of return.

Great! The Financial Professional Will Get Back To You Soon.

Capital budgeting is important in this process, as it outlines the expectations for a project. These expectations can be compared against other projects to decide which one(s) is most suitable. Every year, companies often communicate between departments and rely on financial leadership to help prepare annual or long-term budgets. These budgets are often operational, outlining how the company’s revenue and expenses will shape up over the subsequent 12 months. Companies use different metrics to track the performance of a potential project, and there are various methods to capital budgeting.

Throughput Analysis

The alternatives being considered have already passed the test and have been shown to be advantageous. The company then chooses between several alternatives based on factors such as need, degree of profitability and the useful life of the proposed purchase. To evaluate alternatives, businesses will use the measurement methods to compare outcomes. The outcomes will not only be compared against other alternatives, but also against a predetermined rate of return on the investment (or minimum expectation) established for each project consideration. The rate of return concept is discussed in more detail in Balanced Scorecard and Other Performance Measures.

Accounting Profit vs. Economic Profit Assets

Capital budgeting is key for strategic business finance planning as it allows firms to decide on long-term investments using data. This shapes how much a business will grow and develop in the future. The first step is to use the formula to find the present value of an annuity discount factor.

Simple rate of return LO2

If their goal is to be number one in their industry, capital budgeting can help them invest in projects with that goal in mind. If one or more of the alternatives meets or exceeds the minimum expectations, a preference decision how to keep accounting records for a small restaurant chron com is considered. Once the company determines the rank order, it is able to make a decision on the best avenue to pursue (Figure 11.2). When making the final decision, all financial and non-financial factors are deliberated.

What Is The Capital Budgeting Process?

- If a discount rate is not known, there is no benchmark to compare the project return against.

- As a business expands, problems regarding long-range investment proposals become more important.

- The resulting number from the DCF analysis is the net present value (NPV).

- Under this method, the entire company is considered as a single profit-generating system.

All of our content is based on objective analysis, and the opinions are our own. As mentioned earlier, these are long-term and substantial capital investments, which are made with the intention of increasing profits in the coming years. Approval of capital projects in principle does not provide authority to proceed. Some worthwhile projects may not be approved because funds are not available. The total capital (long/short term) of a company is used in fixed assets and current assets of the firm. Budgets can be prepared as incremental, activity-based, value proposition, or zero-based.

Another major advantage of using the payback period is that it is easy to calculate once the cash flow forecasts have been established. Another type of project for which a basic IRR calculation is ineffective is a project with a mixture of multiple positive and negative cash flows. For example, consider a project for which the marketing department must reinvent the brand every couple of years to stay current in a trendy market. Ancient Cities Tours schedules 12 tours per year from the Peru location.

The company must first determine its needs by deciding what capital improvements require immediate attention. For example, the company may determine that certain machinery requires replacement before any new buildings are acquired for expansion. Or, the company may determine that the new machinery and building expansion both require immediate attention.

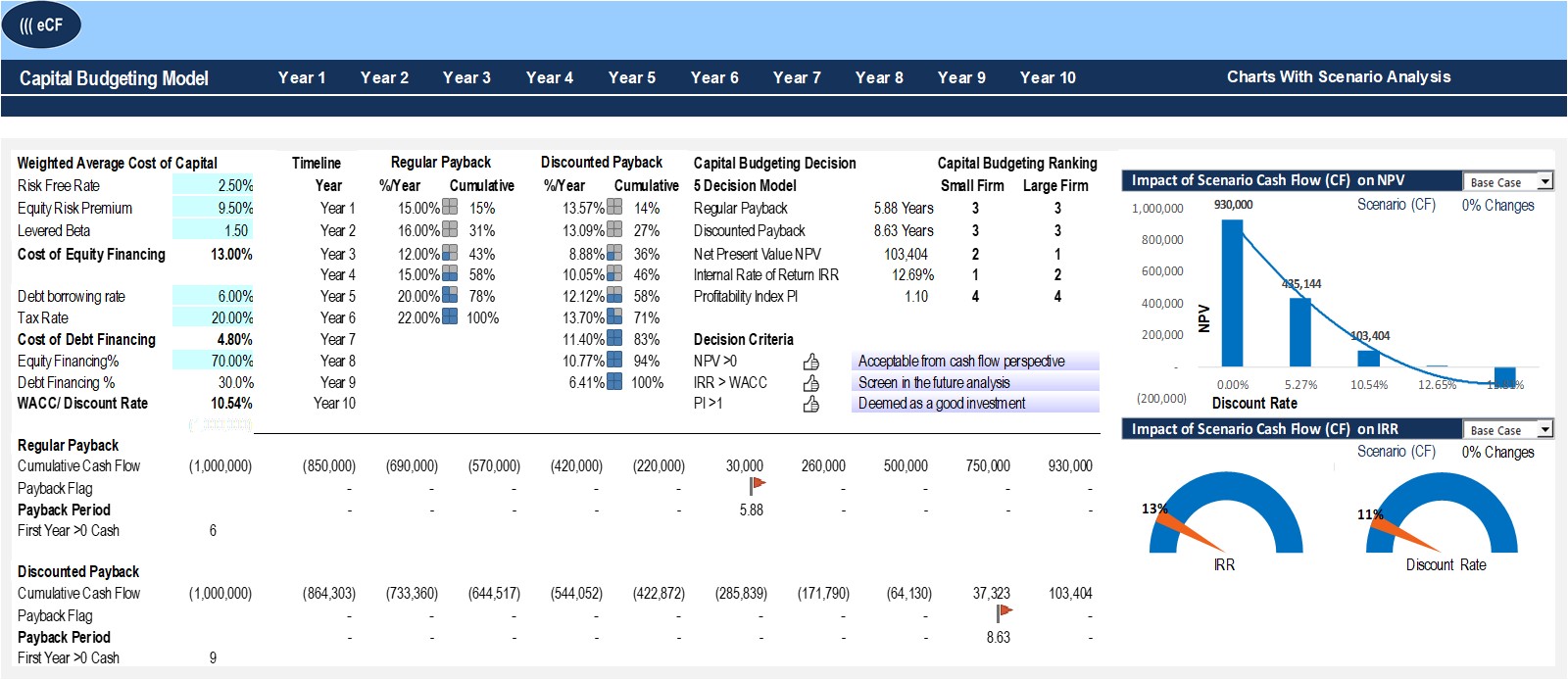

For instance, a company may have a policy of accepting cost reduction projects only if they provide a return of, say, 15 percent. The NPV can be used to determine whether an investment such as a project, merger, or acquisition will add value to a company. If an NPV is positive, the sum of discounted cash inflows is greater than the sum of discounted cash outflows. The company will receive more economic benefit than it puts out, so the project, assuming the return is material and no capacity constraints are met, is beneficial to the company. Recall that IRR is the discount rate or the interest needed for the project to break even given the initial investment. If market conditions change over the years, this project can have multiple IRRs.

The profitability index also involves converting the regular estimated future cash inflows using a discount rate, which is mostly the WACC % for the business. Then, the sum of these present values of the future cash inflows is compared with the initial investment, and thus, the profitability index is obtained. The decision makers then choose the investment or course of action that best meets company goals. Capital investment decisions occur on a frequent basis, and it is important for a company to determine its project needs to establish a path for business development.

A central concept in economics facing inflation is that a dollar today is worth more than a dollar tomorrow, as a dollar today can be used to generate revenue or income tomorrow. Although there are a number of capital budgeting methods, three of the most common ones are discounted cash flow, payback analysis, and throughput analysis. The two broad categories of capital budgeting decisions are screening decisions and preference decisions. Screening decisions relate to whether a proposed project satisfies some current acceptance standard.